One question every presenter wants to know is what makes the perfect pitch deck? How can I make the best possible deck that influences and establishes credibility for my brand. Well, luckily for us, an awesome study done by DocSend helped shed some light on the one thought we all have about the perfect pitch deck.

This study was based on 200 startups who raised $360 million dollars collectively, which results in a data-backed approach to the fundraising process for any seed start-up. Here are a few awesome insights we pulled from the research that you can use to make the perfect pitch deck.

1. Use a maximum of 20 slides

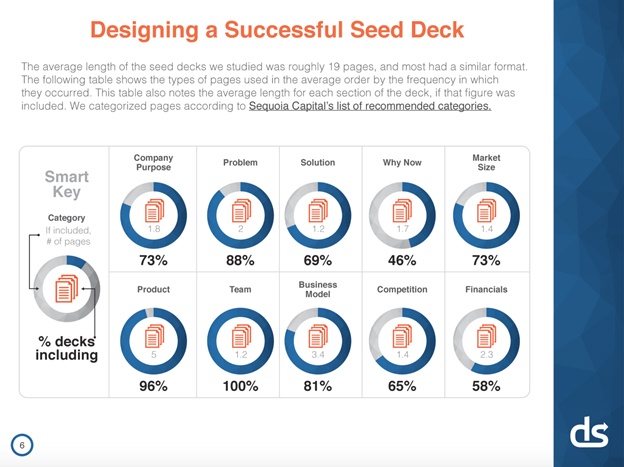

The average seed deck fell around 19 slides and all followed a similar structure. DocSend’s short list of top slides are:

Consider these elements beforehand and tailor your speech to highlight the aspects that will spark your target investors interest.

- Team

- Product

- Business Model

- Market Size

- Company Purpose

There is less emphasis on the solution, why now, competition, and financial. But don’t take this as something your deck shouldn’t have, it should incorporate these where you can.

Key Takeaway: Less is more from slides to design and everything in between. Make sure your deck has these standard slides to improve the effectiveness of your deck.

2. Structure your deck in recommended order

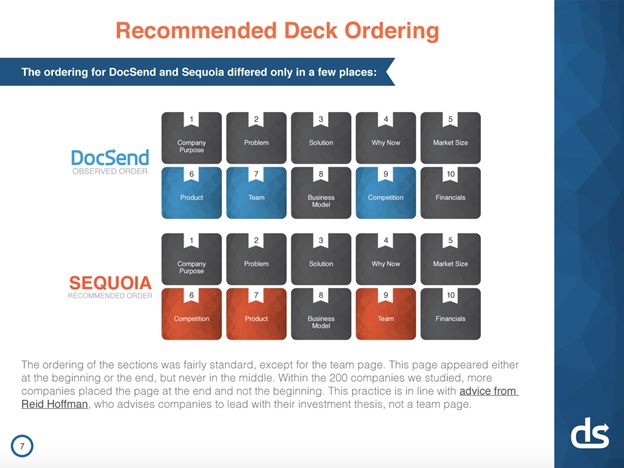

The study revealed a similar order to the Sequoia template discussed in our [link Ultimate Pitch Deck Guide]. However, DocSend concluded the team slide is more effective when placed 7th versus towards the end.

Their results were:

- Company Purpose

- Problem

- Solution

- Why Now

- Market Size

- Product

- Team

- Business model

- Competition

- Financials

This falls in line with LinkedIn Co-Founder Reid Hoffman’s advice to lead with investment thesis over team slide.

The goal here is to identify and understand the current climate of your industry so you can pitch a solution accordingly.

Key Takeaway: There are few options for proper deck structure. Follow these two examples as a baseline and add additional slides if necessary.

Discover More Pitch Deck Examples:link to ultimate guide

3. Capitalize on these valuable slides

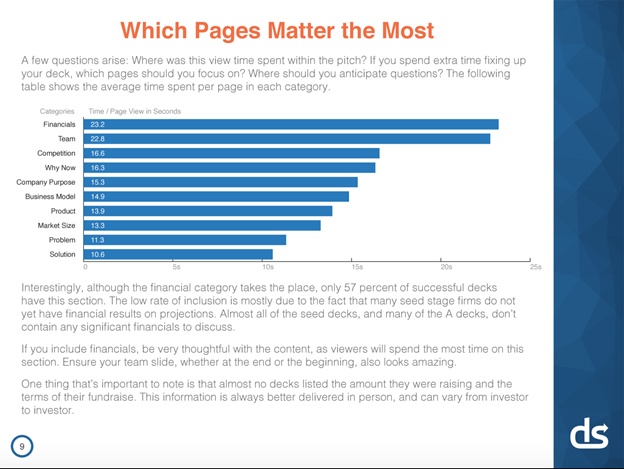

The most important page in the perfect pitch deck is financials. No shock here because investors want to know how they will make money from your money.

For seed and series A fundraisers, there may not be enough data to deliver financials. So if you choose to include this slide, make sure you don’t overshoot projections.

See the image above for DocSend’s order of pages that matter most.

Key Takeaway: If you’re a concept pitch, showcase your team’s expertise to show investors you can proactively handle unexpected challenges. The “Team” slide is nearly equal in importance as financials.

Implement a “Why Now” or “Opportunity” slide. Only 45% of decks had one, yet this slide ranked 4th in importance. Stress your relevance to the market and the problem that needs fixing now.

4. Make your deck mobile-friendly

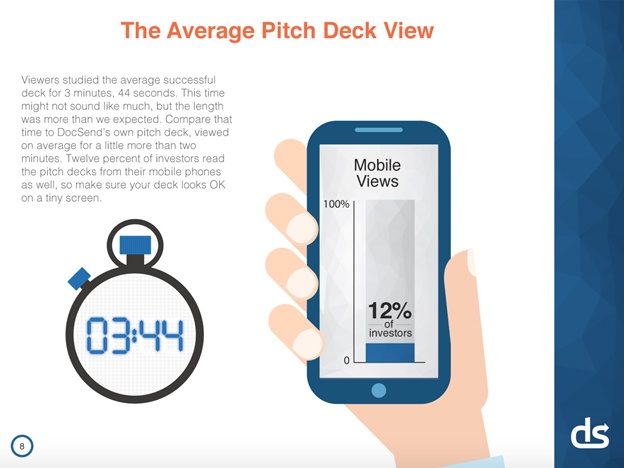

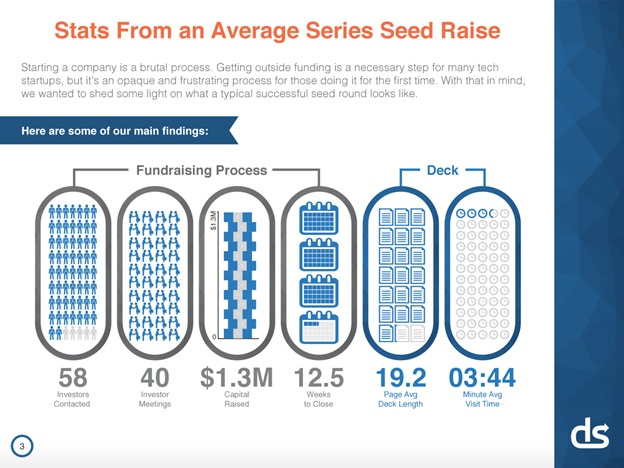

The average investor studies a deck for 3 minutes and 44 seconds. 12% of them view from their smartphones.

Key Takeaway: Test your deck before you send or present it. Make sure it looks good on your mobile device.

You have under 4 minutes to stand out before an investor moves onto the next.

5. Practice patience in the process

This falls outside of your deck design, but is an insight to take with you during fundraising. Be patient, smart, and proactive to get the most out of the process.

One misconception DocSend touches on in this study is how many investors you actually need to contact. It’s believed that the more meetings, the high change you will get funding. However their research shows different.

On average, these successful startups contacted 58 investors and set up 40 meetings. The fundraising process took an average of 12.5 weeks to close, each raising nearly 1.3M in capital.

Key Takeaway: Practice patience. Do research on what investors to pitch to in your industry. Use your network to get a warm meeting instead of sending a cold email blast to a hundred firms at once.

December 1, 2017

December 1, 2017